To be very clear I do not think that CDC is something to be preferred above Defined Benefit (DB) schemes but there are many sectors and workers in this country who have never had the opportunity to DB and are now in dreadful Defined Contribution (DC) provision.

As a relatively young person, I became interested in work related pension provision for 2 main reasons. First, was when my father confided in me that me, he had discovered, far too late to do much about it, that the State Pension would not provide enough money for him to properly retire. He was not unintelligent or uninformed, but he had just assumed that the state pension and a collection of small pension pots he had accumulated over the years would provide him with enough cash to retire, not in luxury but in dignity. He had worked since he was 15 and for many years was a skilled manual worker.

This lack of money meant he had to work part-time for the rest of his life. Not through choice, but to pay the bills.

The 2nd reason was when I started working as a Council housing management officer in the East End of London in the early 1990s. While there was and still is, widespread poverty in this area, it was the poverty of so many older residents, which struck me the most.

So many of them lived hand to mouth, with no holidays, basic furniture, cold homes and little or no money for presents fort their grandchildren. I used to get into work early and would see every Monday morning, pensioners queuing patiently outside the Roman Road Post Office to pick up their pensions, hours before it opened. Rain or shine. Obviously, they had run out of money, hopefully only the Sunday before. Yet the vast majority of them had worked hard all their lives.

Now a lot has changed since then regarding pensions, some good, some bad, some ok

The Labour introduction of Pension credit was transformational. State pension provision is much better and auto enrolment (AE) , while imperfect, is a welcome addition to workplace pensions.

But we have pretty much lost the battle for defined benefit schemes in the private sector while the public sector DB seems to be in a far more healthier position. But decent DB provision in the UK was always a minority sport. I represent 80,000 UNISON members on its NEC, who work for housing associations or charities throughout the UK and Northern Ireland.

Occupational pension provision in the sector is at best hit and miss but pretty rubbish in parts particular in the care sector, where many employers only pay the AE 3% of salaries.

Defined contributions (DC) schemes, and to be frank, pensions in general, confuse workers. They are thought to be expensive, complex, fragmented, volatile and risky. This is true.

- DC schemes do not deliver a pension; they are small investment pots for each member.

- All of the asset management fees and transactions are extracted from their investment pot.

- All the risk of the market value of assets falling is with the member.

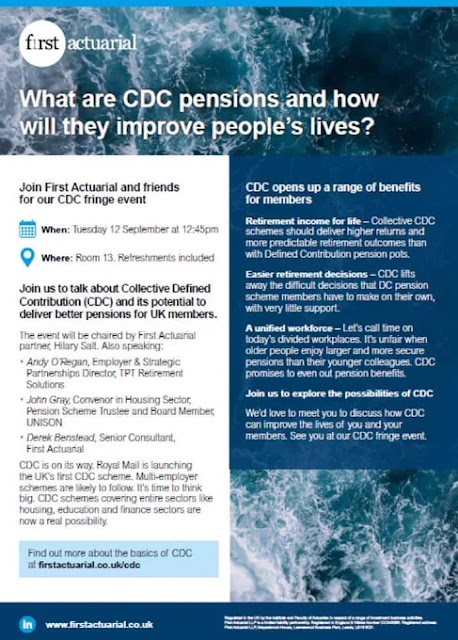

CDC may well appeal to employers who want to offer good pensions to their workforce where they have previously closed their DB scheme. The prospect of a regular and relatively reliable income in retirement will be welcomed by UNISON members who are now in a DC scheme.

DC Pension pots are still small, charges relatively high, and there is a general lack of trust in personal financial services.

So, what is the alternative and why CDC?

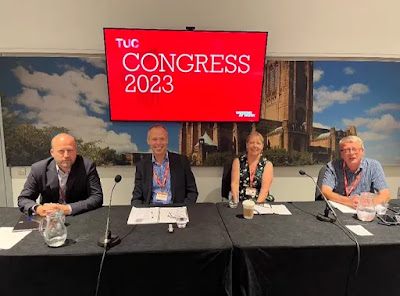

Many years ago, I remember visiting Netherlands with UNISON and being impressed talking to Dutch trade unionists about their CDC schemes. CDC is also found in many other countries.

They were very proud to their scheme and while being prepared to be ruthless in protecting it, believe that it has delivered for their members. Due to scale, they believe it cuts costs, improves investment performance, and manages volatility. They also believe that there was improved governance, in particular for Labour rights.

One more important reason for trade unionists to consider CDC is that it is an opportunity for unions to involved actively in the design and operation of these schemes. To be frank, there are many other countries where trade union density and influence is greater than in ours. Trade unions in these countries tend to provide more services than we do in the UK.

I think there is a connection and believe that CDC is an opportunity to provide better pensions, make trade unions even more relevant to members and a potential recruitment prospect"