This is my presentation to this fringe. Hat tip Paul Hunter from PRIC for excellent speech notes.

"Thank you Clive. I am delighted to be here in Liverpool and looking forward to today’s discussion.

I am John Gray, I’m councillor in Newham, I’m chair of Newham Pensions Committee and I am here as vice-chair of the Local Authority Pension Fund Forum (known as LAPFF) which represents the interests of 87 public sector pension funds and 7 pool companies. I also wear various trade union pension hats.

If any of you have worked or work in local government, the chances are you will have a pension with one of our member funds. If we have any councillors in the room, you or colleagues may well sit on the pension committee.

As you can imagine as a major UK employer, our local authority pension funds have a lot of members which means collectively we hold a significant amount of assets – around £350 billion - much of which is invested in large international companies. Around 6 million Brits have Council pensions

The role of LAPFF is to engage with investee companies on the way they treat our planet, how they behave towards people, and more generally the way that they are run and managed.

These issues matter in and of themselves, but as trustees of pension funds they also matter because they carry significant investment risks and opportunities. Indeed, for anyone with a pension these issues should also matter to you because failure to consider them puts at risk your retirement income.

In this context and that of our topic for discussion, I thought I would use my time today to focus on three main areas (in fringe speeches everything comes in threes'):

·

Why greenwashing is an issue for investors.

·

What investors can do to tackle it? ·

And from an investor perspective the role government could play.

So why does greenwashing matter to investors?

The risks of climate change to our planet, society and economy should go without saying. However, in truth they cannot be repeated enough. From an investor point of view, climate change poses systemic risks to the whole economy, impacting every single investment. There are also specific risks for companies we are invested in, that will undoubtedly be left behind by the energy transition if they don’t decarbonise their business model quickly enough.

But where does greenwashing fit in here. Well to start, if information provided by a company is unclear or misleading then assessments of risks may be inaccurate which will affect investment decisions and could leave us as investors exposed.

It also means that stewardship activity we undertake could be impacted, including which companies to engage, in the asks we make of company chairs in meetings we have with them and in the voting positions we take at Annual General Meetings.

To give you an example of what we experience. We too often see companies describe themselves as having science-based climate targets. What’s not to like about that, who can argue with science.

However, when you look under the bonnet of the statements, we see a more complicated picture.

This can include a climate target which only covers so-called Scope 1 and 2 emissions – emissions from a company’s own activity – and not scope 3 emissions - pollution from their product which is used by its customers. And in the case of an oil and gas company or a carmaker that is precisely where most emissions are and where real climate risks lie.

In such instances where information is unclear, the climate risks facing a company could be masked while at a macro level it could breed complacency about the pace of climate action.

But what can investors do?

To start, investors should look beyond the glossy green images within sustainability reports and not take the information that is provided by companies at face value.

A good example of this is on the issue of planting trees to offset emissions. Leaving aside the cost or the displacement of people, when we as LAPFF added up the tree planting proposals of major emitters you know what we concluded? That we were going to need a much bigger planet to plant all those trees.

Investors also have a role more generally in scrutinising plans and the expectations we make of companies. Setting out a long-term target is not enough when action is needed now. So short term targets which can be measured and not avoided through greenwash is an essential ask of investee companies.

But we don’t just have a role in assessing information and asking for more, we also have a role in challenging companies. And on the issue of offsetting emissions our engagement with companies is bearing fruit with growing recognition of the limits offsetting will deliver.

And where plans are not credible or misleading, collectively investors should be doing more to voice their concerns and escalate action by voting against company directors at AGMs.

But we can’t do this alone. Which brings me on to the last point, the role of government.

Greenwashing is clearly an issue that regulators and governments are looking at, both regarding company disclosures but also green taxonomies, investment products and sustainability labels.

This is good first step but there are further interventions which could help further.

The first area is mandatory company disclosures. If we are going to distinguish between a company that is taking action and one that’s just talking a good game, then we need hard and comparable numbers within company reports covering areas such as investment in the transition.

Second, when the Transition Plan Taskforce reports government should push ahead with setting out expectations for how companies should undertake, integrate, and report their climate plans. This will make information comparable and clearer which will help guard against greenwashing.

And it is critical that these expectations of companies include how they are considering the social dimensions of the transition. A shift to net zero will only happen if we have a just transition for workers, communities and consumers.

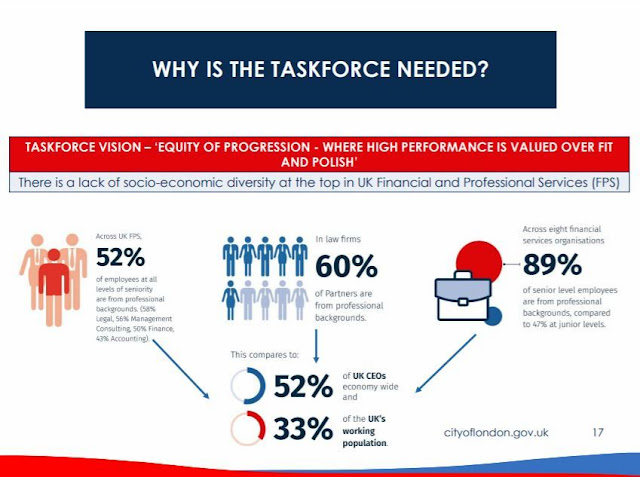

Third, government can look at the corporate governance code, including around whether to make sustainability committees compulsory and requiring companies to produce a skills matrix so we can see the actual competency of boards on issues such as climate change.

And lastly, as investors we feel we should be able to have a direct say on company climate plans. LAPFF has been writing to companies calling for a vote on transition plans which will help scrutinise plans to both guard against greenwashing and ensure credible strategies are in place. But we think these votes at large listed companies should be put on a mandatory basis. In France, a proposed law is in the process of being passed which will do just that and could easily be adopted in the UK.

So, to conclude:

·

Greenwashing matters because it threatens the pace of the transition and for us as investors it creates risks – and time is very much of the essence.

· From an investor perspective, we have a role in scrutinising information and challenging greenwashing – after all we own these companies.

· And lastly, to empower investors to do more, government can help by mandating improved transparency from companies. This would then enable shareholders to challenge plans that do not appear credible. Thank you.